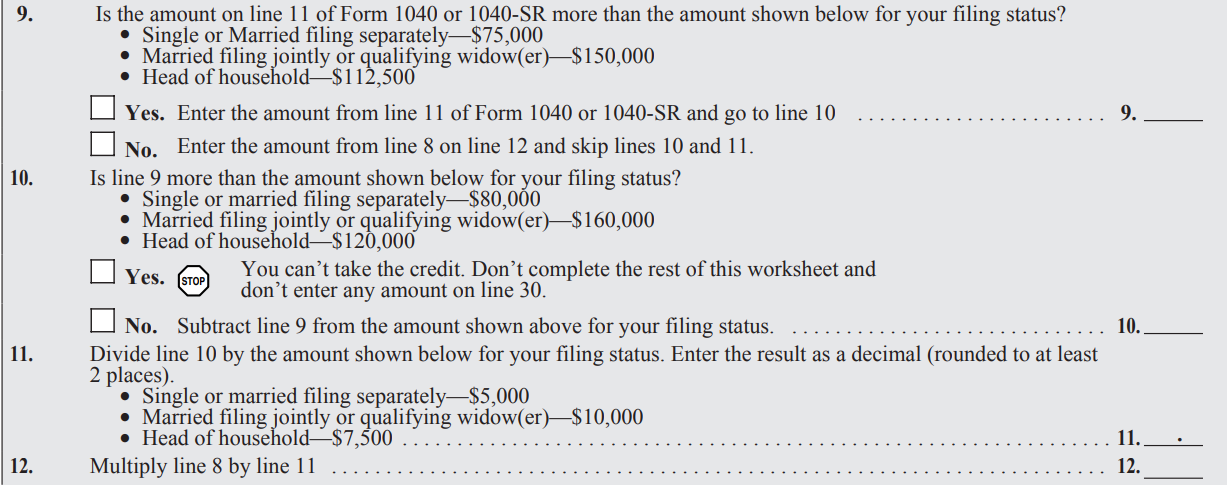

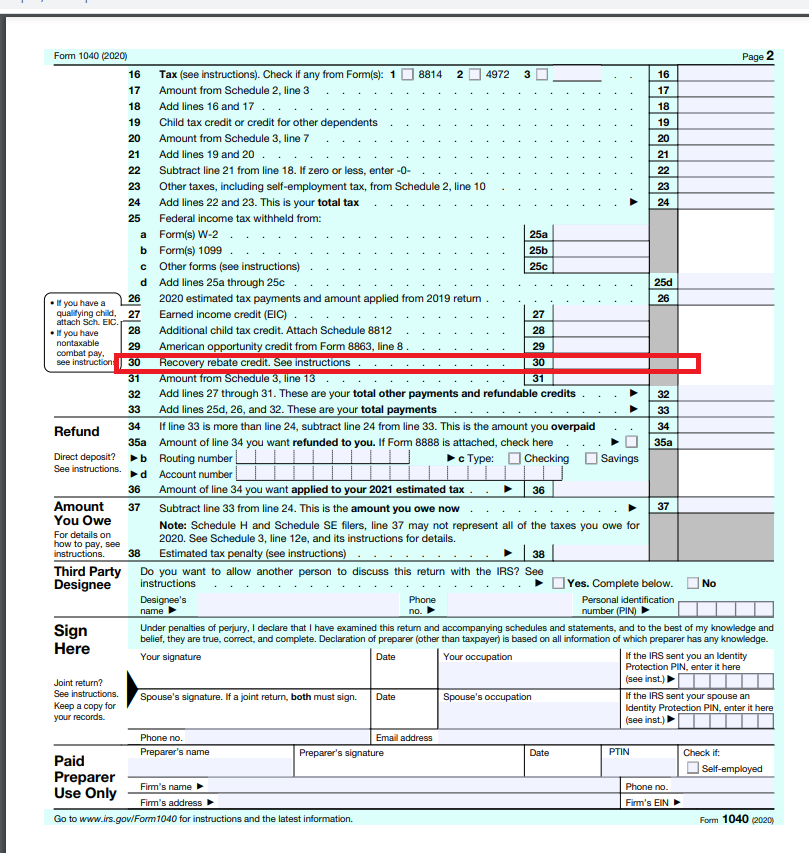

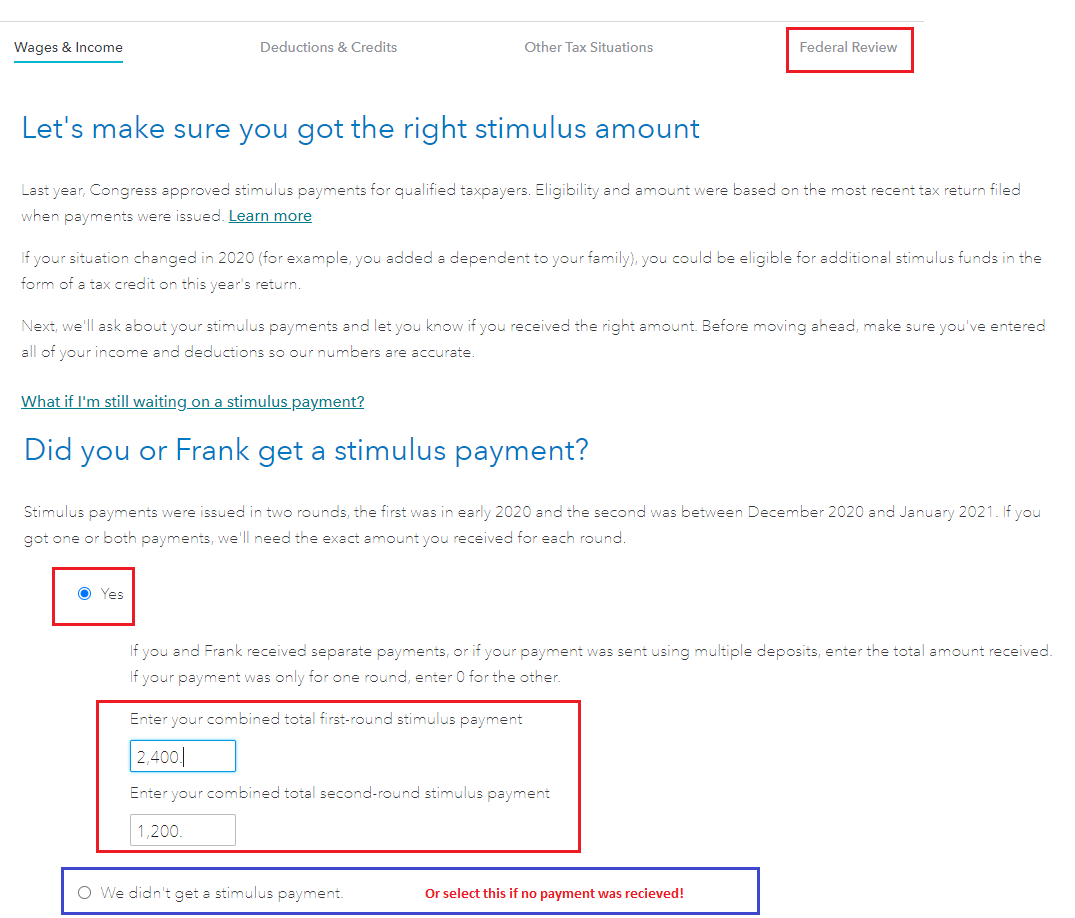

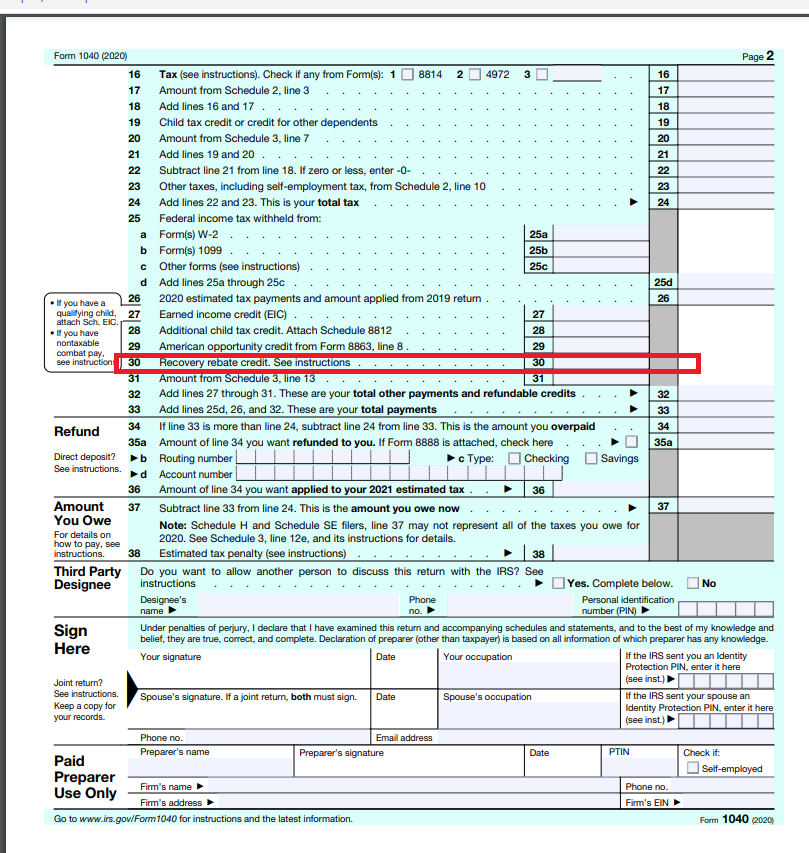

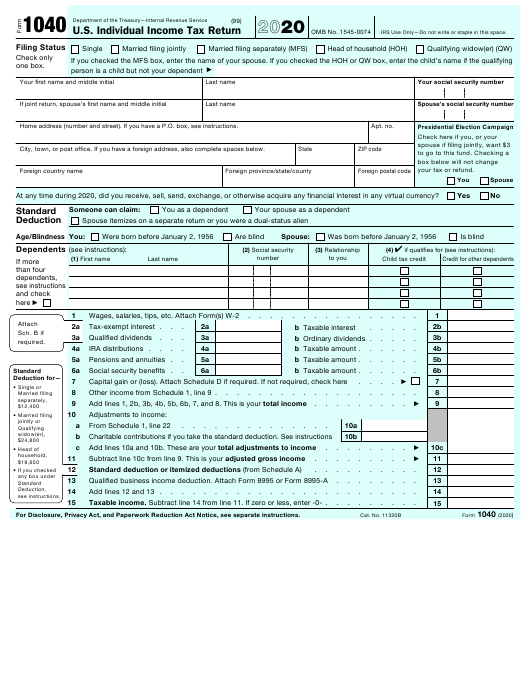

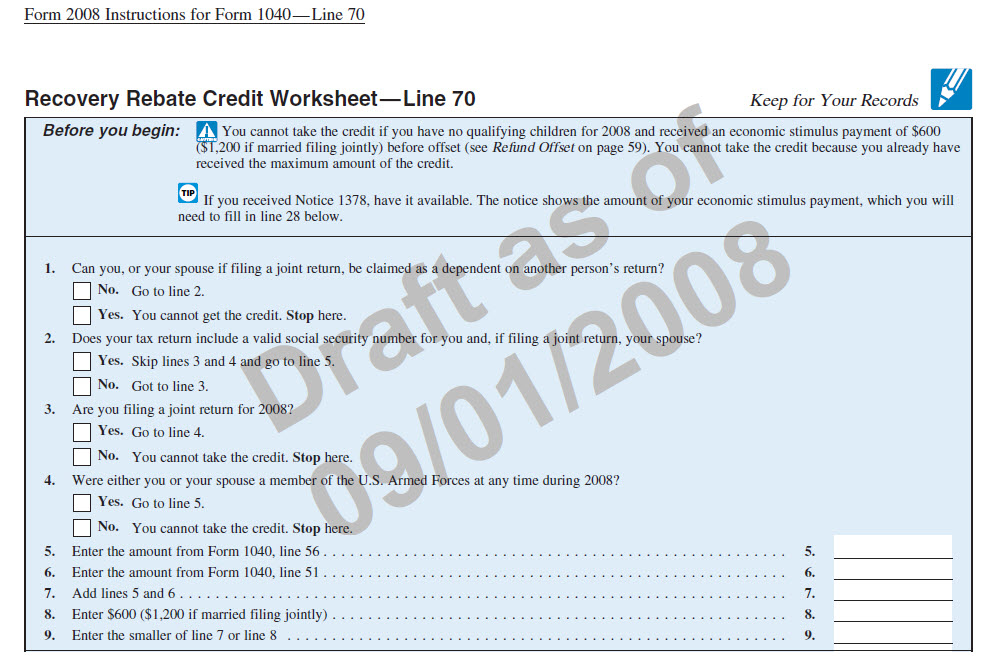

Line 13 Recovery Rebate Credit

Line 13 Recovery Rebate Credit – A Recovery Rebate gives taxpayers an possibility of receiving an income tax refund without the need to alter their tax returns. This program is run by the IRS. It’s completely cost-free. It is nevertheless important to know the regulations and rules governing the program prior to filing. Here are … Read more