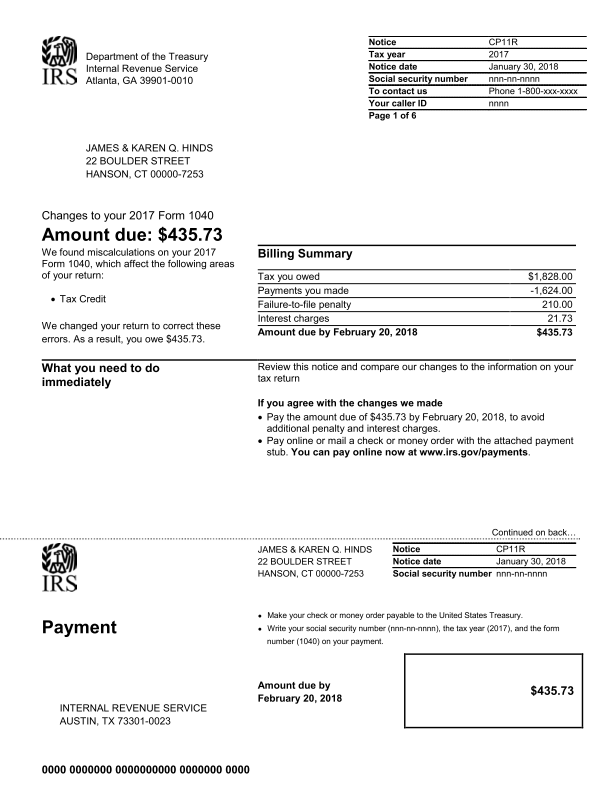

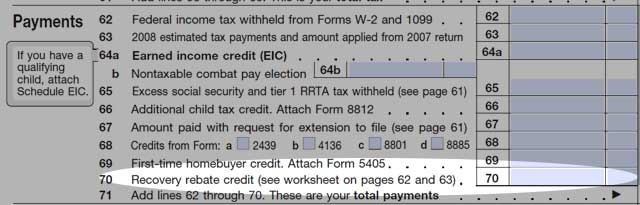

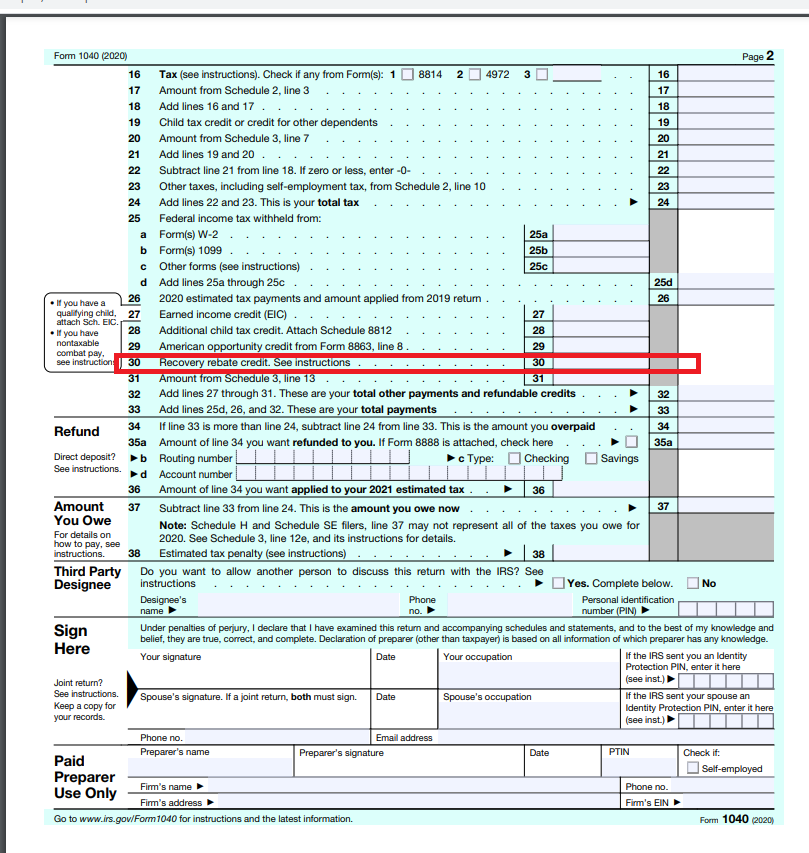

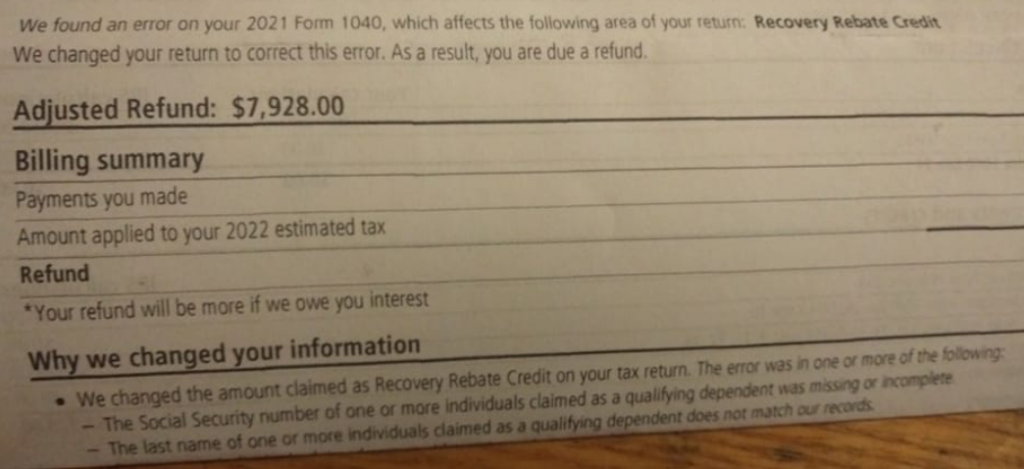

Irs 2022 Recovery Rebate Credit

Irs 2022 Recovery Rebate Credit – A Recovery Rebate is an opportunity taxpayers to claim an income tax refund, without having to alter their tax return. The IRS manages the program and it is a completely free service. It is, however, crucial to understand the regulations and rules governing this program before you file. Here … Read more