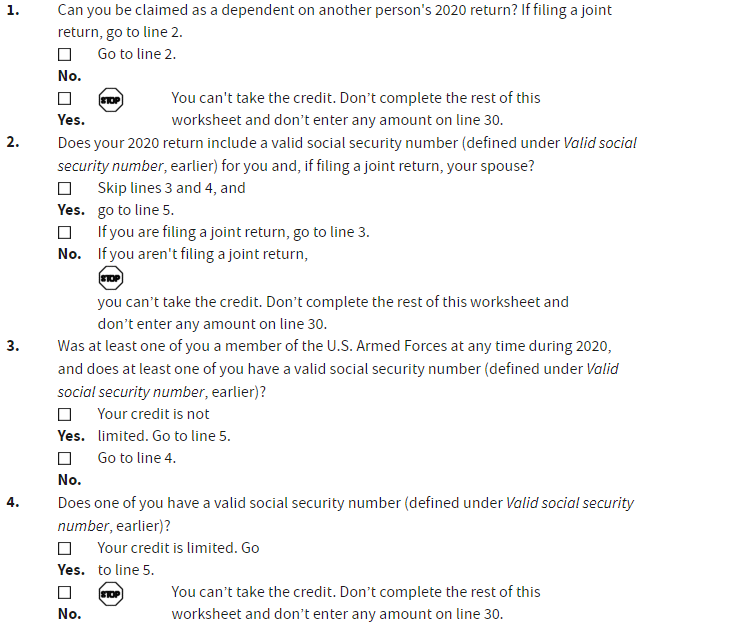

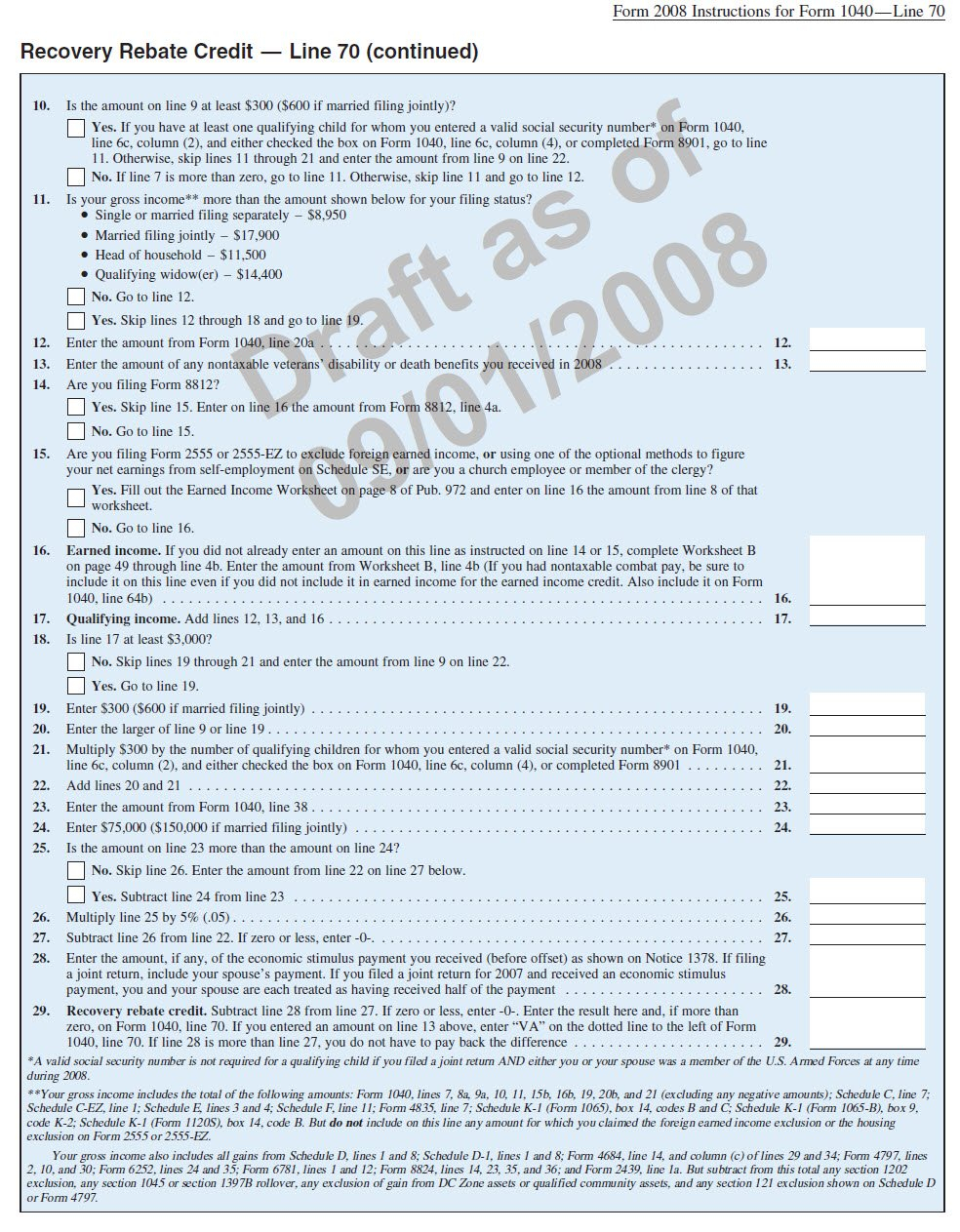

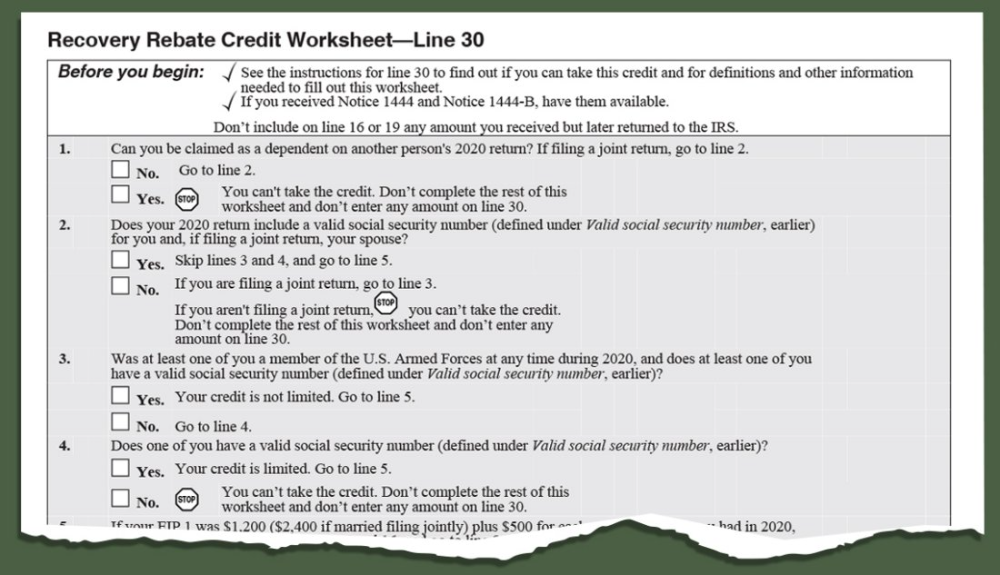

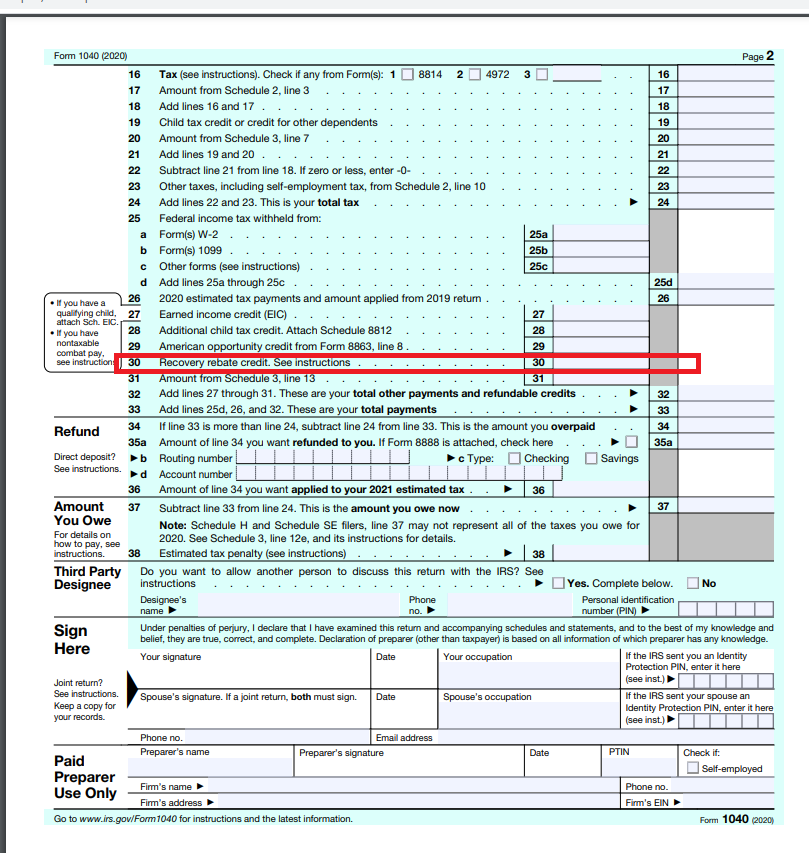

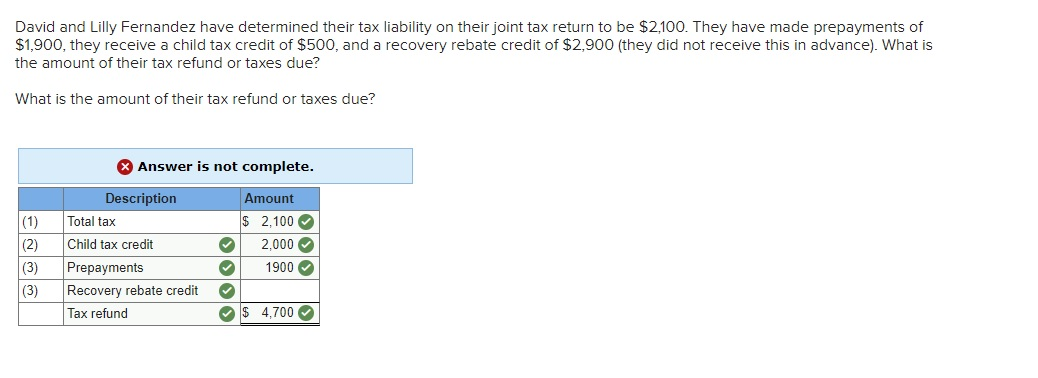

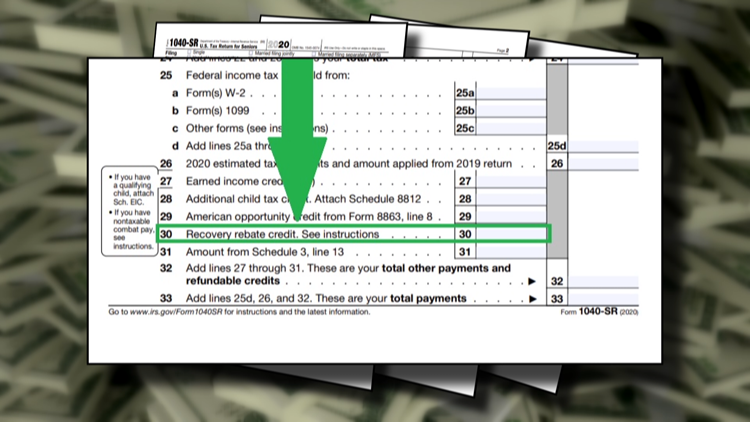

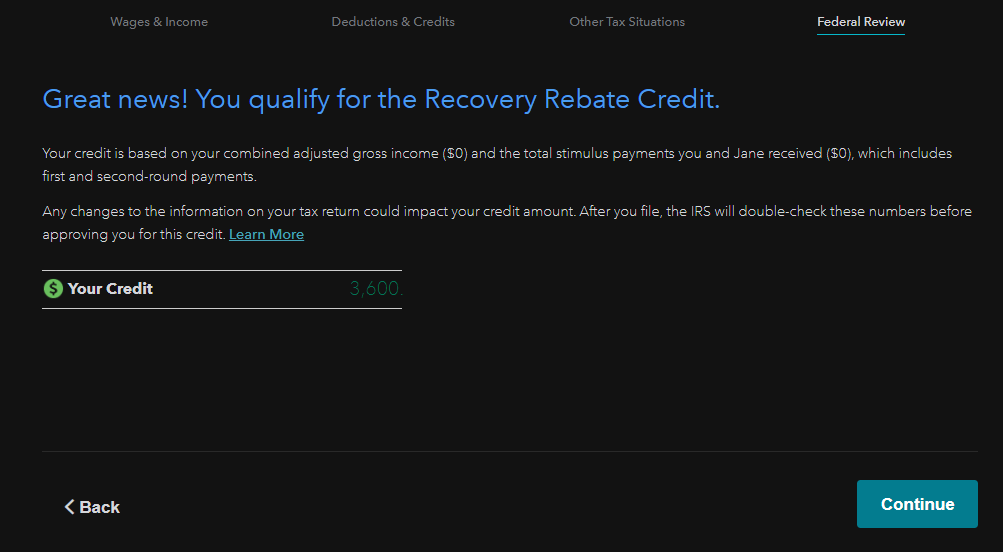

Am I Eligible Recovery Rebate Credit

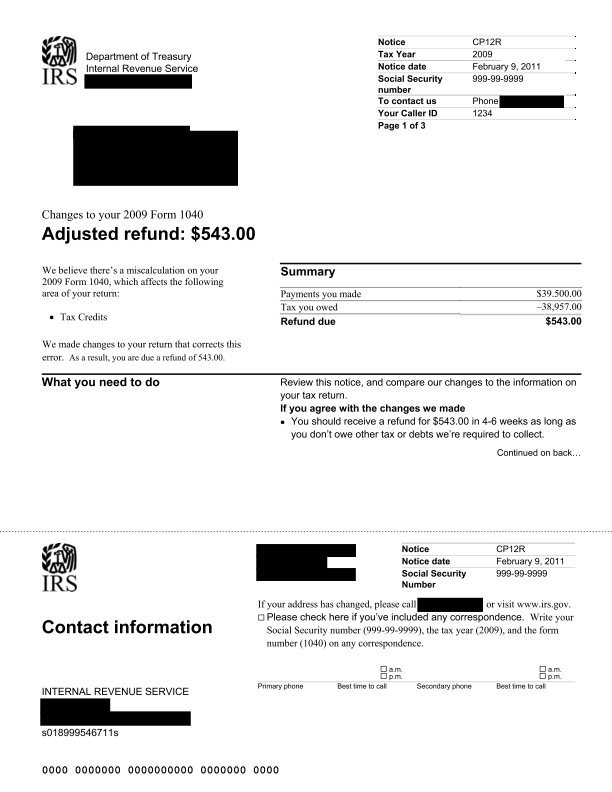

Am I Eligible Recovery Rebate Credit – A Recovery Rebate is an opportunity taxpayers to claim a tax refund without adjusting their tax return. This program is administered by the IRS and is a no-cost service. However, it is important to know the rules and regulations governing the program prior to filing. These are the … Read more