Already Filed Taxes But Forgot Recovery Rebate

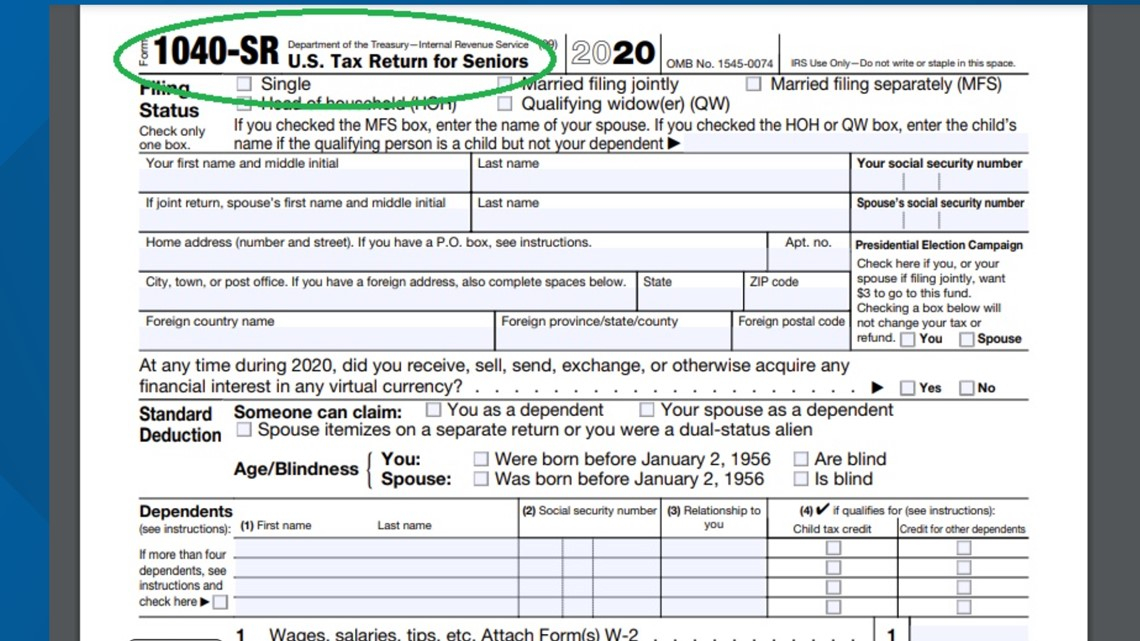

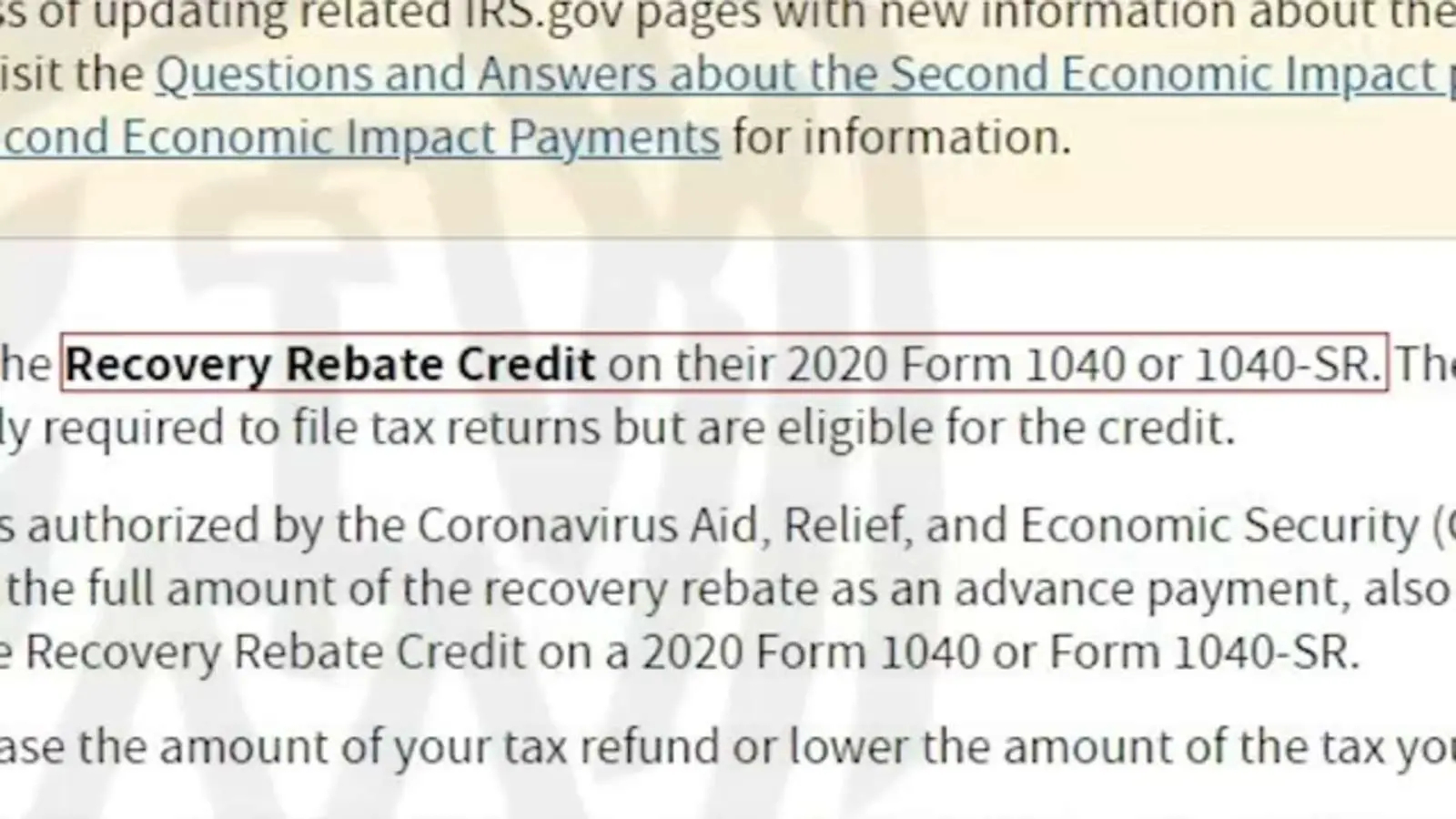

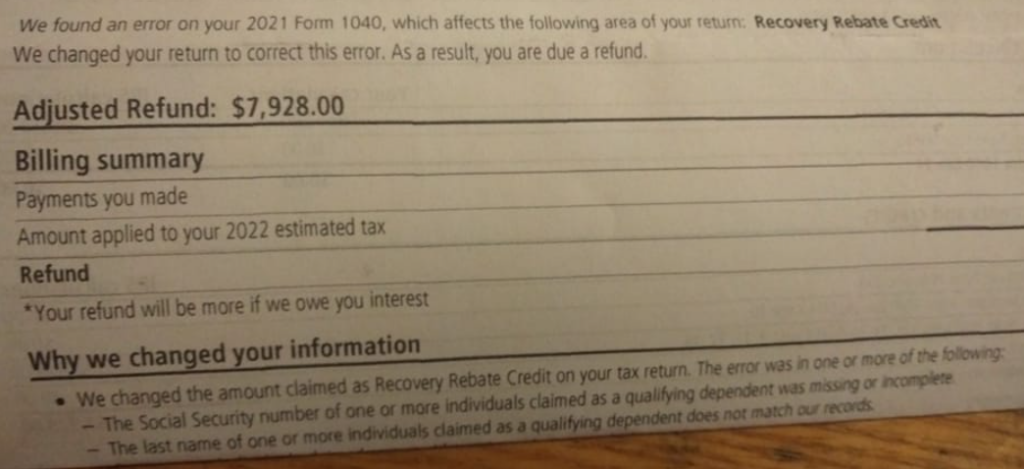

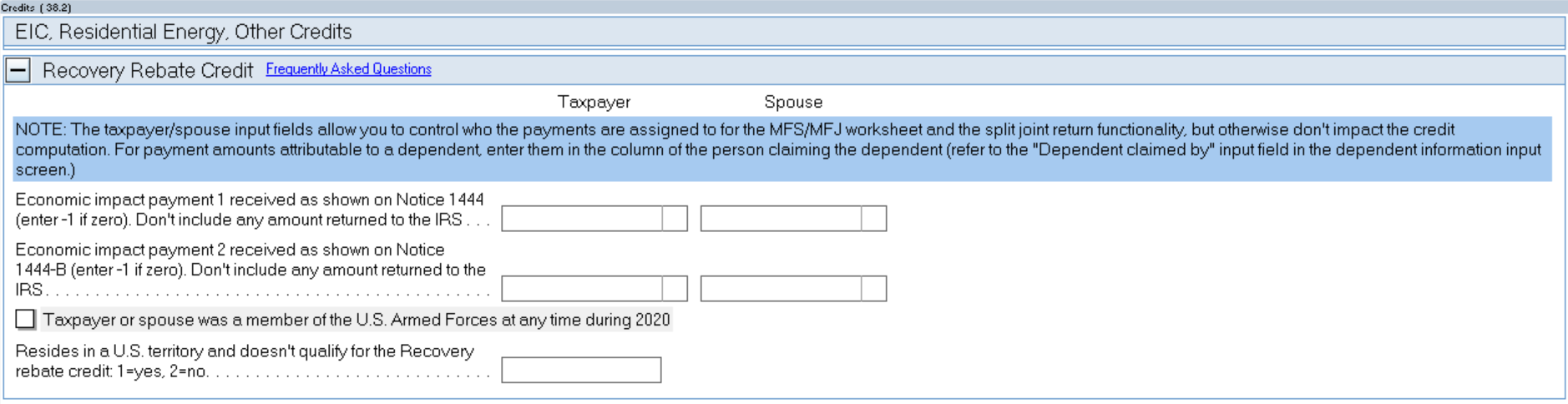

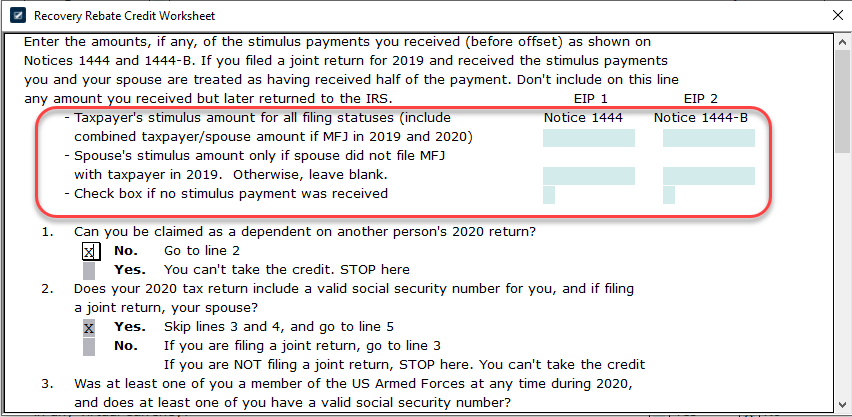

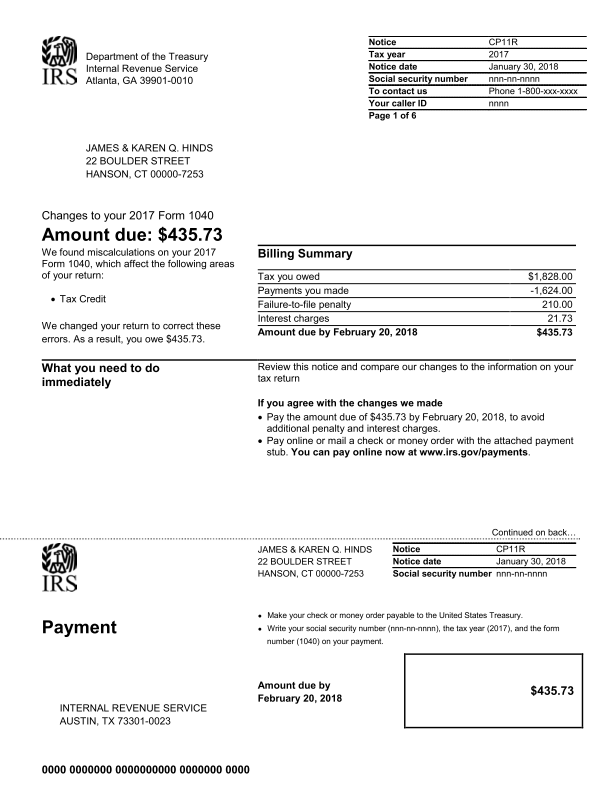

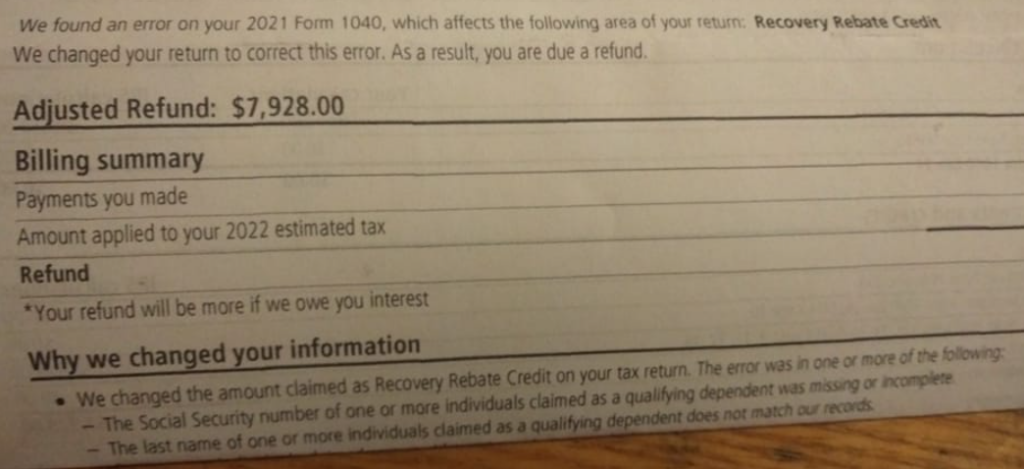

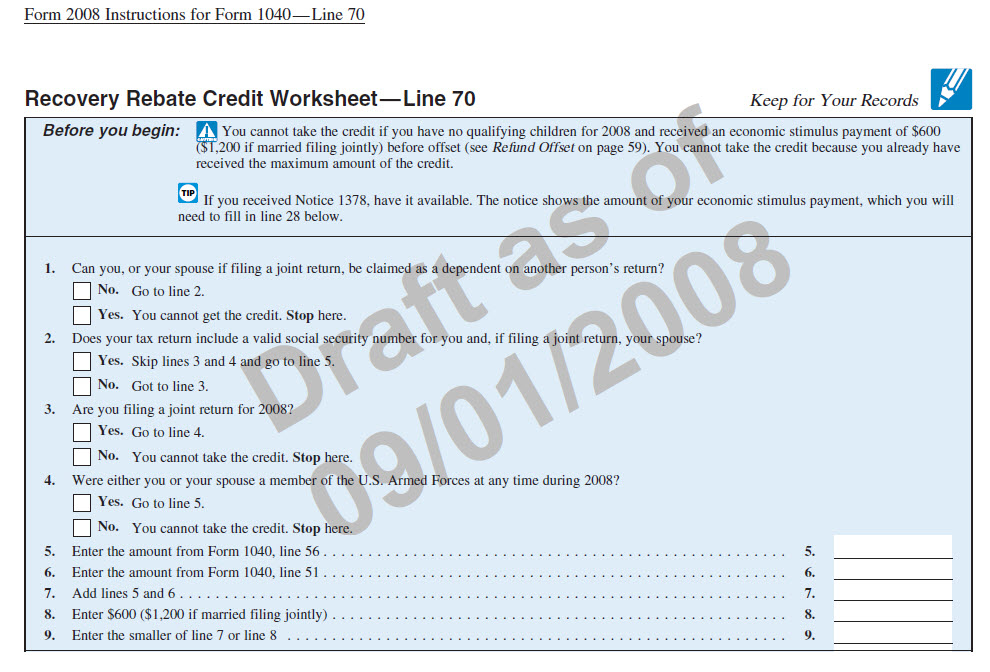

Already Filed Taxes But Forgot Recovery Rebate – The Recovery Rebate offers taxpayers the opportunity to receive an income tax return, without having their tax returns adjusted. The program is provided by the IRS. It is absolutely free. However, prior to filing it is important to understand the regulations and rules. These are some facts … Read more